Abstract

Does tax incentive trigger local economic growth? This paper explores this issue by exploiting the differentials in the entry of new private firms across counties on the border of China’s Western Regional Development Strategy (WRDS). The WRDS introduces a reduction of 18% of corporate income tax for firms in the western areas in China after 2000 if they belong to the sectors encouraged by the central government. Comparing contiguous border county-pairs in a triple DID framework we find that the increase in new entrants of private firms eligible for tax reduction is larger in the treatment counties than those control ones. We find that new entrant increases in treated counties not at the cost of significant loss in nearby untreated counties. We further find that whether a treatment county gains from tax reduction depends on its local economic and institutional condition.

The WRDS and tax incentives policy

The Chinese government launched its Western Region Development Strategy (WRDS) in January 2000 in response to a growing gap between the coastal and inland regions in the 1990s. We draw a boundary between those the central government has defined to the western areas and the rest of the country using GIS. As outlined in the ‘Overall Plan of Western Regional Development during the Tenth Five-Year Plan Period’ (2001–2005), the WRDS combines a vast and sprawling number of policies and objectives in terms of financial support, infrastructure development, education investment, cooperative measures, and industrial policies. As part of the WRDS, tax incentives scheme is given to investors or firms in the western regions for qualified industries listed on the catalogues promulgated by the state. Enterprises set up in the western regions are eligible to enjoy a reduced corporate income tax rate of from 33 % to 15% as their main business belongs to these encouraged industrial sectors. To qualify for the reduced tax rate, an enterprise must derive 70 percent or more of its revenue from the business listed in the catalog.

Differentials in New Entrants

Our paper examines the growth effect of such location-based tax reduction related to the WRDS through attracting economic activity of entrepreneurship in the targeted areas(Liu, Wu, and Wu, 2019). Previous literature on accounting and entrepreneurship provides the taxation variations across locations to identify the responses of new firms using data in developed countries. Bartik (1991) summaries the earlier studies related to the effect of local taxation on the location of new firms since the 1960s in the United States. These researches produced mixed results, with some finding no effect of taxes on attracting entrepreneurial activities while others disclosing the negative impact of this policy. Recent work finds there is a positive relationship between local taxation and entrepreneurial activities at a more disaggregated spatial unit. For example, Bruce and Deskins (2012) investigate this issue focusing on the state level tax policies in U.S. Duranton et al. (2011) assess the impact of local taxation on the spatial distribution of entrepreneurial activities using the microgeographic data in U.K.

We define entrepreneurial activity as the newly established firms in the private sector for two reasons. On the one hand, empirics often define entrepreneurs as those who have started a business within the last several years, or even self-employers. For example, urban economics literatures such as Glaeser and Kerr (2009) and Rosenthal and Strange (2010) define the entrepreneurial activity as the founding of new firms. On the other hand, in the context of China, neither new SOEs nor new FOEs are consistent with the dynamic nature of entrepreneurial activities. Previous empirical studies show that the state-owned enterprises (SOEs) in China are less subject to market incentives. Meanwhile, most of the FOEs are those production sectors belonging to multinational companies.

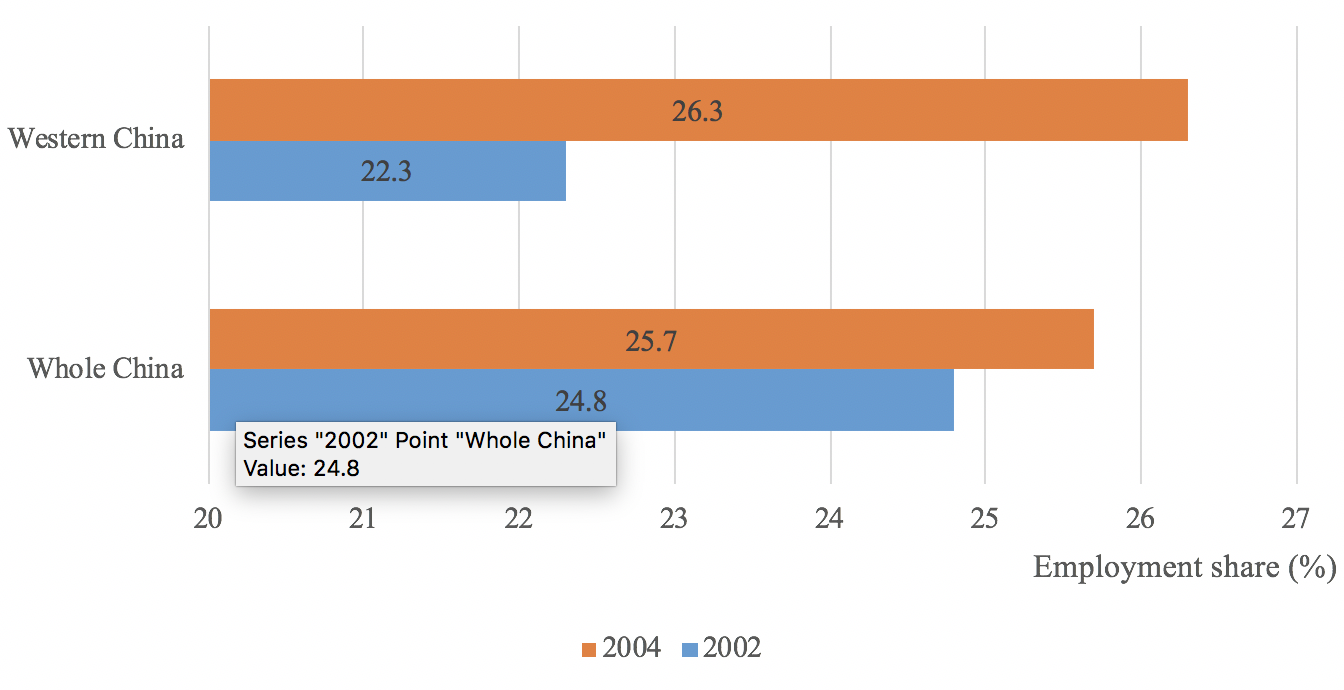

Similar to U.S and UK, the new entrants in China are found to be of great significance for local economy. Using two rounds of economic census data conducted by China’s National Bureau of Statistics (NBS) in 2002 and 2004, which contain information on all firms, we calculate the employment share of new manufacturing firms at the county level. Fig.1 shows the mean employment share of new entrants with no more than 3 years for both the whole China and for western China’s provinces. It is found that new firms play an important role in job creation at the county level with an average of 25% share in local employment. Moreover, the western counties have experienced a bigger growth in employment share brought by new firms after the implementation of the WRDS.

Fig.1 Mean employment share of no more than 3-year old new entrants across counties

Identify the effect of tax incentives on new firm entries

We examine the effect of tax incentives on the entry of new private firms. We use the 2000 WRDS that provides tax breaks to firms encouraged by the central government in the provinces of Western China as a policy discontinuity setup. We compare outcomes before and after the policy implementation in the treatment area to those in its contiguous control one. To validate our identification, we restrict our samples to the counties close to the border of policy.

We draw on data in this analysis from three main sources. First, the newly established firms prior to the implementation of the Western Regional Development Strategy (WRDS) are collected from the Basic Unit Survey 2002. Conducted by National Bureau of Statistics (NBS). The second data source is the Economic Census 2004 by NBS in China. We exploit the information for manufacturing firms founded between 2002 and 2004 from the Economic Census 2004 and those founded in Year 2000 and 2001 from the Basic Unit Survey 2002 to construct the post-WDRS sample.

Our paper shows that new private firms eligible for tax incentives are more likely to locate in the counties on the west side of the border of WRDS after 2000(see Fig.2). This finding is robust to several robustness exercises. To argue that our finding is of significance in investigating tax effect on regional development when using border counties as the samples of analysis, we extend our analysis in three respects. First, we examine the displacement effect and find that the conducive effect of tax reduction is not driven by firm relocation from the control to the treated sites. This suggests that our estimated treatment effect does not overstate the aggregate effect of the location-based tax reduction policy associated with the WRDS. Second, we examine the heterogeneity of treatment effect. Our result indicates that new private entrants are more attracted to locations with strong existing base for industries eligible for tax incentives, justifying the role of agglomeration economies in attracting new firms (Greenstone et al. 2010, Glaeser and Kerr 2009, Kline and Moretti 2014). Finally, we expand our samples to those within a 200 km-wide ring away from the border of policy, in which non-border counties are included. Our estimation results reveal that such positive effect remains but with a smaller magnitude compared with the border county samples. This can explain why recent studies focus on the border region of a taxing jurisdiction to identify tax effect.

Fig.2 The change in estimators on the dynamic effects of tax incentives over time

Conclusion

Our paper evaluates the effect of tax incentives on the entrepreneurial activities using China’s Western Regional Development Strategy (WRDS) as a policy experiment. In particular, we exploit whether the location-based tax reduction and exemption policy help create new entrants in the eligible sectors towards the western counties after the launch of the WDRS in 2000. By constructing contiguous county pairs on the border of the WRDS, we conduct a triple difference-in-difference estimation. The results show that counties on the west side of the border have experienced a larger increase in the entry of new private eligible firms after the implementation of the WDRS in 2000. Such results are robust to several robustness exercises. Moreover, we find that such effect decays as moving away from the border of policy.

Our analysis illustrates such effect is not merely through shuffling firms from the untreated to nearby treated counties. This suggests that there is no displacement effect of tax incentive related to the WRDS for counties close to the border of policy. We also examine the heterogeneous effect of such location-based tax incentive. It is found that the effect of tax incentives on attracting new entries is relatively larger for counties in targeted western areas with strong local industrial base and favorable market condition. This indicates that tax reduction policy effects differ across areas with different local economic conditions.

Our paper provides an important insight into how a local area gains from the tax incentive policy through attracting entrepreneurial activities. The positive effect of tax policy should be interpreted with caution as we restrict our samples to the border counties for identification. Further research is required to examine the general equilibrium effect of location-based tax incentive program to gauge the external validity of the causal effect.

References:

Bartik,T. (1991). Who benefits from State and Local Economic Development Policies. Kalamazoo, MR: W.E. Upjohn Institute for Employment Research.

Bruce, D.& Deskins, J. (2012). Can state tax policies be used to promote entrepreneurial activity? Small Business Economics,38, 375-397.

Duranton, G., Gobillon, L., & Overman, H.G. (2011). Assessing the effects of local taxation using microgeographic data, Economic Journal, 121, 1017-1046

Glaeser, E.L., & Kerr, W.R. (2009). Local industrial conditions and entrepreneurship: How much of the spatial distribution can we explain? Journal of Economics & Management Strategy, 18 (3), 623-663.

Greenstone, M., Hornbeck, R., & Moretti, E., (2010). Identifying agglomeration spillovers: Evidence from winners and losers of large plant openings. Journal of Political Economy, 118(3), 536-598.

Kline, P., & Moretti, E.(2014). Local economic development, agglomeration economies, and the big push: 100 years of evidence from Tennessee Valley Authority. Quarterly Journal of Economics, 129(1): 275-331.

Liu,K.,Wu,H.H., & Wu,J.F.(2019). Location-based tax incentives and entrepreneurial activities: Evidence from private new firms in China. Small Business Economics, 52(3), 729-742.

Rosenthal, S.S., & Strange,W.C. (2010). Small establishments/Big effects: Agglomeration, industrial organization and entrepreneurship. In:E.L. Glaeser (eds.), Economics of Agglomeration. NBER Books, National Bureau of Economic Research, InC., 277-302.